What qualifies for the investment boost

For industrial air systems, the good news is straightforward: almost all New Zealand new depreciable assets that first become available for use on or after 22 May 2025 will qualify for Investment Boost. This covers the vast majority of compressed air equipment:

- Rotary screw compressors: The workhorses of industrial compressed air

- Reciprocating compressors: Perfect for intermittent high-pressure applications

- Oil-free compressors: Essential for food processing, pharmaceuticals, and electronics

- Portable compressors: Flexible solutions for construction and maintenance

- Air treatment equipment: Dryers, filters, and separation systems

- Compressed air storage tanks: Pressure vessels and receiver tanks

- Compressed air piping systems: Distribution networks and infrastructure

The key requirements are simple: the asset must be new (or new to New Zealand) and first used in your business on or after 22 May 2025. Second-hand equipment that's been used in New Zealand before won't qualify, but imported equipment that's new to the country does.

Real numbers, real impact

Let's look at what this means in practice. Say you're considering a $150,000 rotary screw compressor system for your manufacturing plant:

- Traditional depreciation: You'd typically depreciate this over 10-15 years, claiming roughly $10,000-15,000 annually.

- With Investment Boost: You immediately deduct $30,000 (20%) in year one, plus begin depreciating the remaining $120,000.

At a 28% company tax rate, this is equivalent to paying $8,400 less tax in the first year. That's money that stays in your business, improving cash flow precisely when you've just made a significant capital investment.

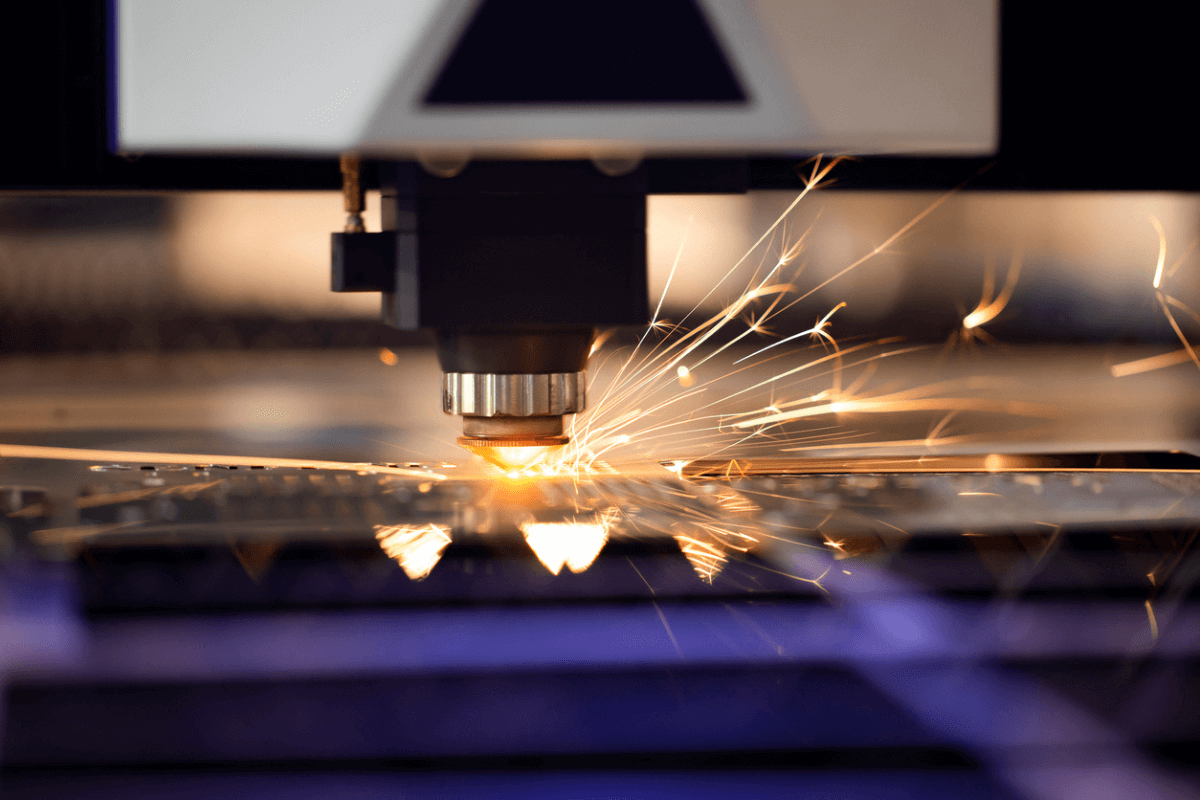

Why this matters for compressed air

Industrial compressors represent one of the largest energy costs in most manufacturing operations. Many businesses discover through a compressed air audit that their existing systems are costing far more than expected in energy and maintenance. Newer, more efficient systems can dramatically reduce operating costs, but the upfront investment has always been a barrier.

The Investment Boost changes this calculation fundamentally. Business investment raises the productivity of workers, lifts incomes and drives long-term economic growth. For air compressors specifically, this translates to:

- Immediate cash flow relief when you're making the investment

- Faster payback periods on energy-efficient equipment

- Competitive advantage through improved reliability and lower operating costs

- Modernised operations that can handle increased production demands

.png?width=1068&height=680&name=vixen%20and%20nitropak%20(3).png)

Planning your investment

The policy runs indefinitely, but there are practical considerations for timing. You can claim Investment Boost in your income tax return for the year you buy a new asset. For most businesses, this means equipment purchased and commissioned before 31 March will provide the maximum benefit in the current tax year.

If you've been considering upgrading your air compressor, the numbers now work differently. Sometimes, buying new might work out cheaper overall once the tax saving kicks in, compared to second-hand alternatives or continued maintenance of ageing equipment.

Making the most of investment boost

Remember, this is optional. Businesses can choose to continue depreciating assets under the standard rules if that suits their financial situation better. For most profitable businesses, however, the immediate deduction provides clear advantages.

There's also a claw-back rule: if an asset that received the Investment Boost is later sold for more than its adjusted tax value, the gain must be declared as taxable income. This ensures the benefit aligns with genuine business investment rather than asset flipping.

The Investment Boost represents a genuine opportunity to modernise your compressed air systems while improving your tax position. For businesses that have been putting off equipment upgrades, the timing couldn't be better. The policy rewards productive investment exactly when New Zealand's economy needs it most.

Download our comprehensive guide to understand how modern systems can make a difference in your operations while taking advantage of these new tax benefits.

.jpg)